maine excise tax rates

Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. The excise tax you pay goes to the construction and repair of roadways in the state.

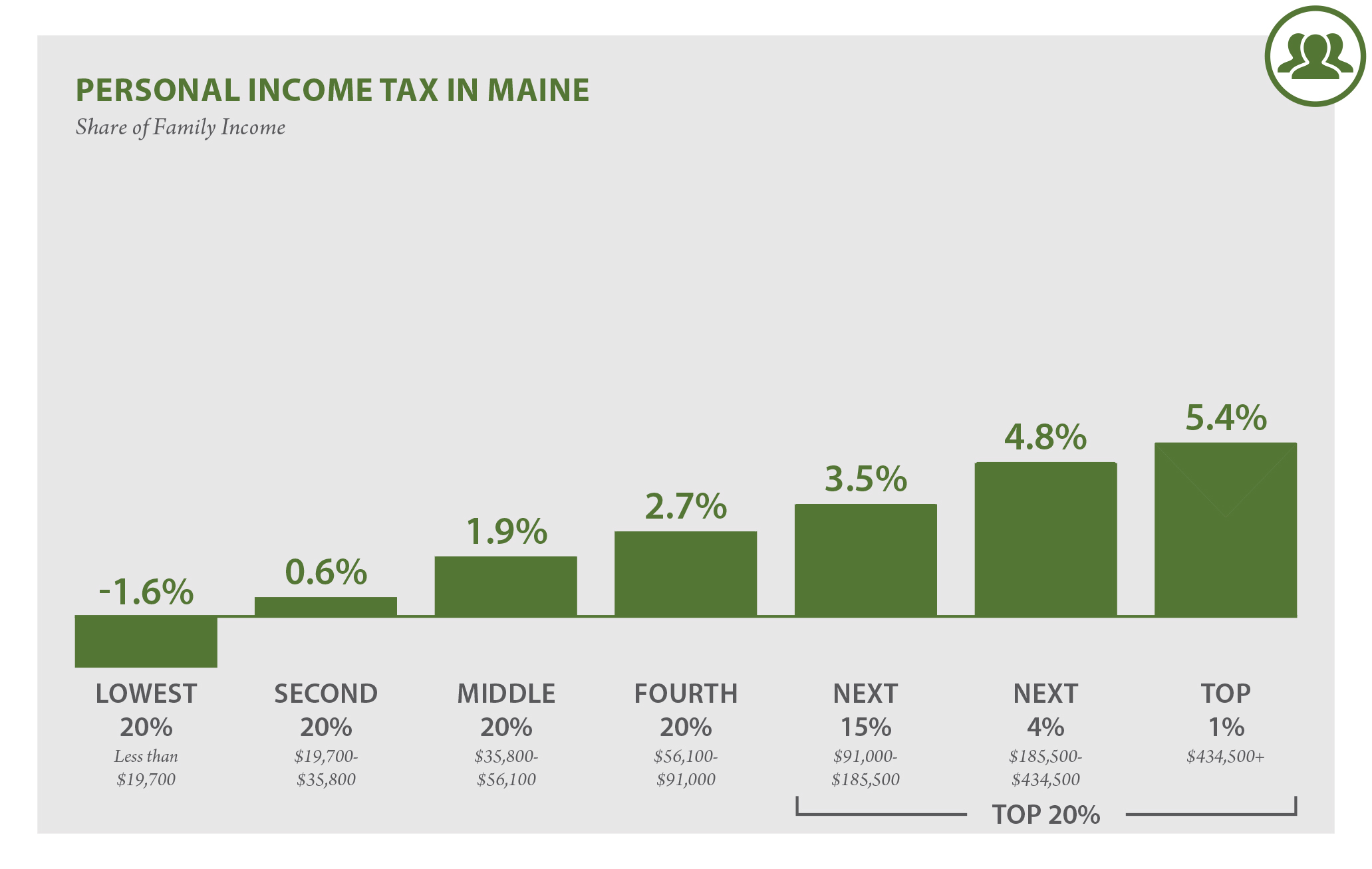

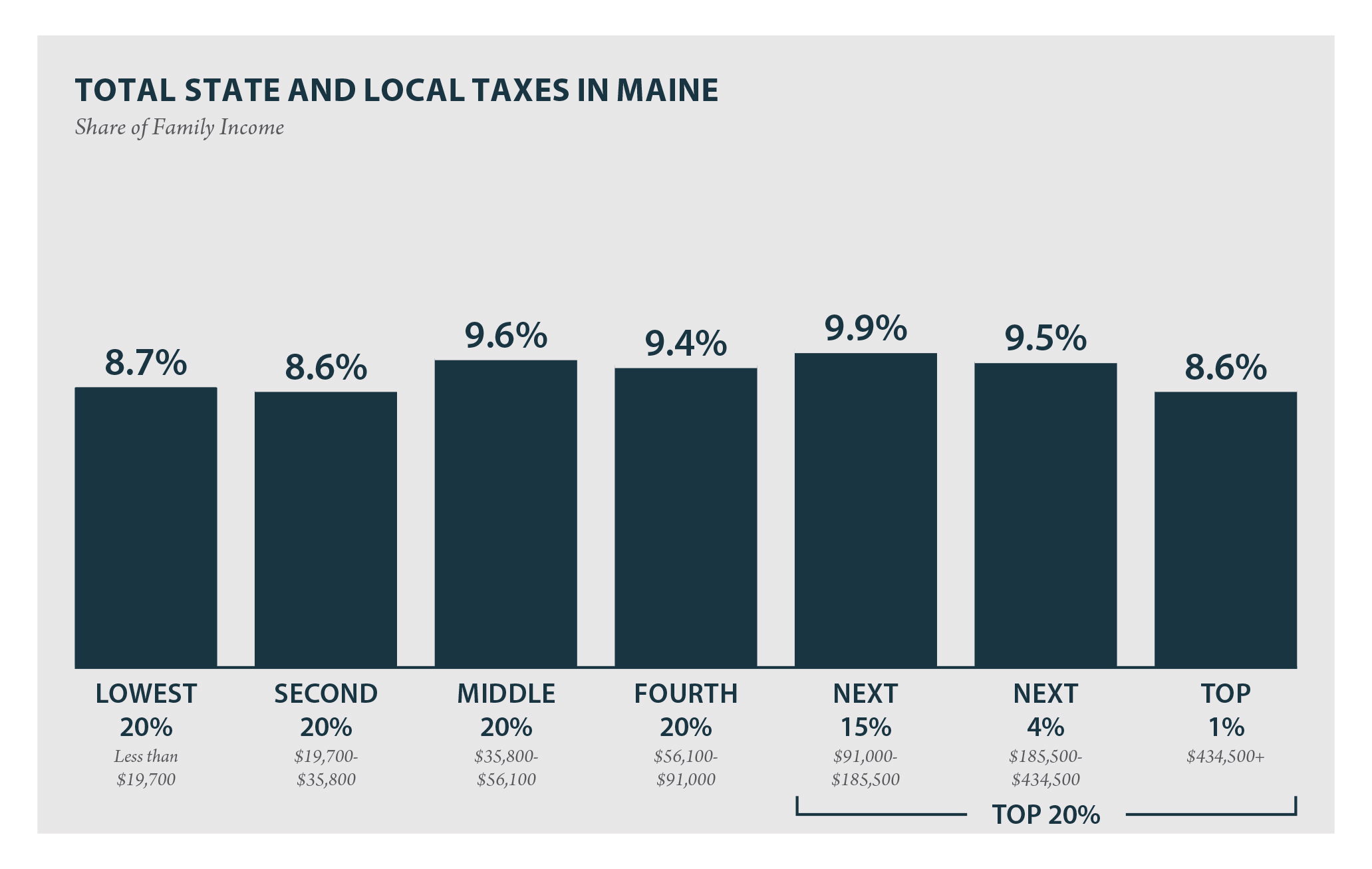

Maine Who Pays 6th Edition Itep

2018 -- 650 per 1000 of value.

. The minimum tax is 5 for a motor vehicle other than a bicycle with motor attached 250 for a bicycle with motor attached 15 for a camper trailer other than a tent trailer and 5 for a tent trailer. Overall length of watercraft to nearest footLength Tax. 2022 Watercraft Excise Tax Payment Form.

22500 X 0100 225. 2019 -- 1000 per 1000 of value. 2020 -- 1350 per 1000 of value.

Watercraft under 13 feet all dories regardless of length and all canoes regardless of length6. The following tax is assessed based upon the overall length of the watercraft. MSRP manufacturers suggested retail price Newer vehicles will generally be more expensive to.

Visit the Maine Revenue Service page for updated mil rates. 2022 -- 2400 per 1000 of value. Mil rate is the rate used to calculate excise tax.

How much is the Excise Tax. 2017 Older -- 400 per 1000 of value. The amount of tax you pay depends on two things.

Maine calculates this tax by taking the current MSRP of your vehicle and multiplying it by the mileage rate. To calculate your estimated registration renewal cost you will need the following information. The rates drop back on January 1st each year.

16 rows 1 CNG Hydrogen and Hydrogen CNG tax rate is applied to every 100 cubic feet. It provides an estimate to give you an idea of what your registration renewal amount will be. Rates for years 1990 through 2020 MS Excel Rates for years 1990 through 2020 PDF.

The excise tax due will be 61080. The age of the vehicle 2. Below you will find the Town of Eliot Boat Excise Tax Payment Form for downloadcompletion along with the Maine Watercraft Excise Tax Table for computing the boat excise tax due.

A 500 agent fee has been included. The age of the vehicle 2. When a vehicle needs to be registered an excise tax is collected during the registration.

Excise Tax is calculated by multiplying the MSRP by the mil rate as shown to the right. Departments Treasury Motor Vehicles Excise Tax Calculator. The amount of tax you pay depends on two things.

This calculator does not provide a quote. Spinney Creek Tide Gate Schedule -. 2018 -- 650 per 1000 of value.

A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. Please contact our office 207-439-1817 with any questions or for assistance with the calculation of the excise tax due. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle.

Excise tax is paid at the local town office where the owner of the vehicle resides. Share this Page How much will it cost to renew my registration. Watercraft Excise Rate Chart.

2017 Older -- 400 per 1000 of value. Maine Cigarette Tax - 200 pack. 2021 -- 1750 per 1000 of value.

Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle. The excise tax on a stock race car is 5. Visit the Maine Revenue Service page for updated mil rates.

This information is courtesy of Larry Grant City of Brewer Maine The same method will be used to calculate the fees to re-register the same vehicle. HOW MUCH IS THE EXCISE TAX. Calculation will be based on.

Boat Launch Season Pass - Piscataqua River Boat Basin. As of August 2014 mil rates are as follows. Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle.

MSRP manufacturers suggested retail price HOW IS THE EXCISE TAX CALCULATED. In Maine wine vendors are responsible for paying a state excise tax of 060 per gallon plus Federal excise taxes for all wine sold. Rates for years 1990 through 2021 MS Excel Rates for years 1990 through 2021 PDF.

YEAR 1 0240 mil rate YEAR 2 0175 mil rate YEAR 3 0135 mil rate YEAR 4 0100 mil rate YEAR 5 0065 mil rate YEAR 6.

State Alcohol Excise Tax Rates Tax Policy Center

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Maine Who Pays 6th Edition Itep

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

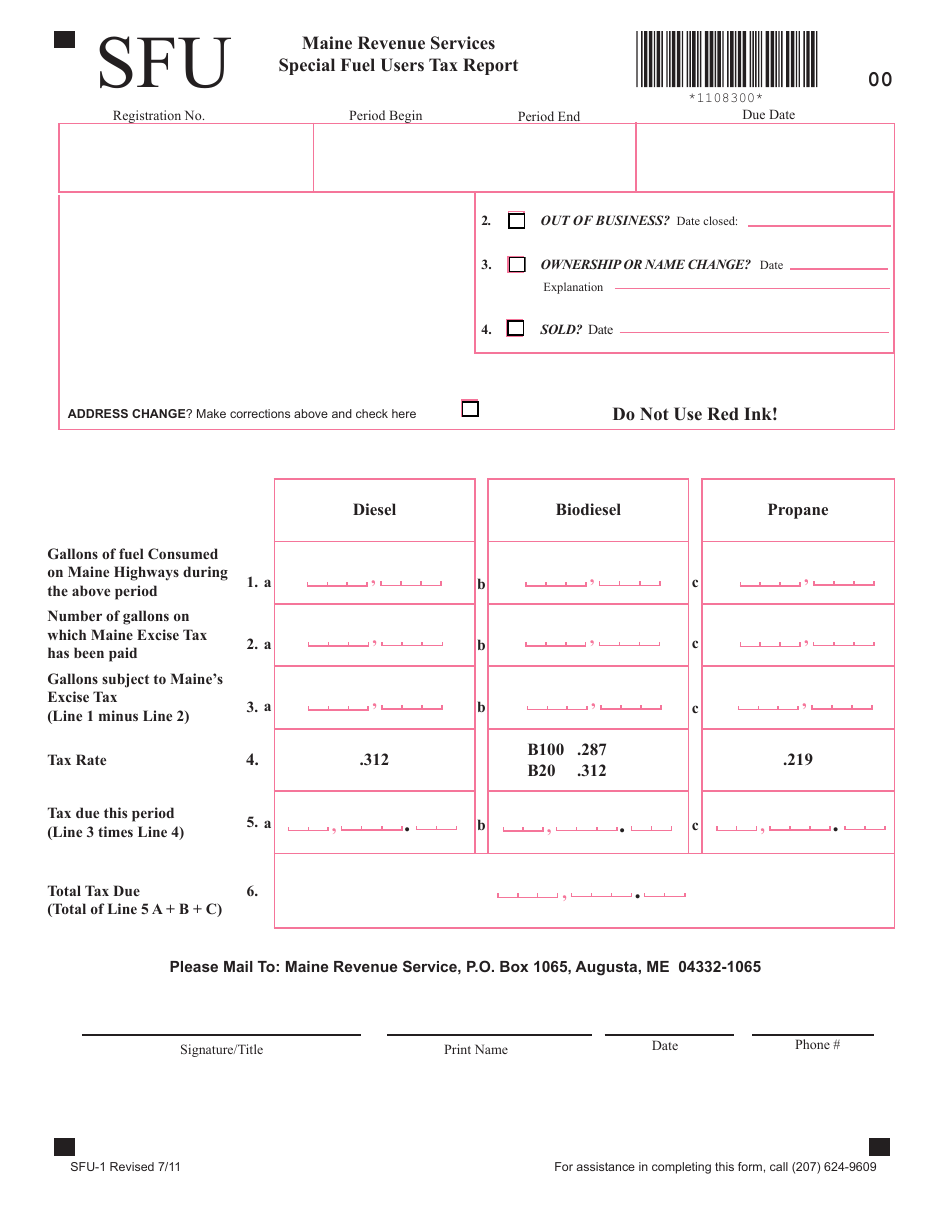

Form Sfu 1 Download Fillable Pdf Or Fill Online Special Fuel Users Tax Report Maine Templateroller

Tax Maps And Valuation Listings Maine Revenue Services

Maine S Governor Proposes To Replace The Income Tax With A Broader Sales Tax Tax Foundation

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

Maine Who Pays 6th Edition Itep

Maine Cigarette And Tobacco Taxes For 2022

Maine Sales Tax Small Business Guide Truic

Historical Maine Tax Policy Information Ballotpedia

Cigarette Excise Taxes In Select States Per Pack Infographic Http On Wsj Com K81nby Infographic The Selection Tax